Posted by Dan Phelan on Mon, Aug 22, 2011 @ 09:45 AM

Certificates of Insurance updates and suggestions. Please take all commentary with a grain of salt depending on the state you perform work in, and because there are exceptions to the majority of what I wrote below...

1. If an upstream party has a 10 million dollar umbrella, and expects all their subs to carry limits equal to or in excess than that, they need to be flexible about changing subcontracts to reflect a realistic limit requirement that smaller subcontractors carry. We've found this to be a fairly easy push back when our subs are being asked to carry limits that are excessively high for the type of work they do, or their scope of work for a particular project. If you don't push back, and have a large claim, there can be severe breach of contract problems because you are out of compliance with what you signed.

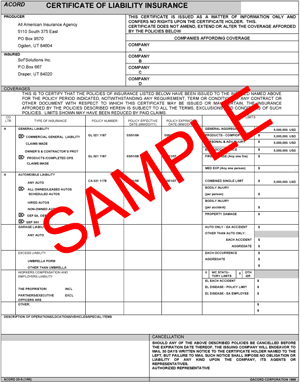

2. The standard Acord certificate of insurance has been updated. There are no more endeaver to's, or 10, 30, 60, or 90 day notice of cancellation fields. If you're the upstream party, request the downstream party to attach the endorsement on their policy that states their policy's cancellation clause. Check with your agent/lawyer, and have them update the sample certificate you provide your subs with to comply with the new industry standard version. The insurance industry is still working out some of the kinks, and this gets complicated because different states have different reporting periods. Sometimes they can even be different for each line of coverage, so check with your agent. One big thing to remember, is that the only entity that will be informed of this cancelation is the 1st named insured, usually the cert holder. So if you have a description of ops listing 15 gov't entities, LLCs, holding companies, architects, owners, and whomever else, the only one that is getting a notification of cancelation is the company whose name is in the cert holder field.

3. Additional Insured. If your subcontractors are naming or listing your company as additional insured in the description of ops, do not assume that you are an additional insured without asking for a copy of the AI endorsement on your sub's GL, Auto, and Umbrella policies. And in CT at least, you cannot be added as additional insured on your sub's work comp policy so stop asking!

4. Waiver of Subrogation. Just like with additional insured status, a sub can't just write in the description of ops that a waiver of subrogation applies in favor of additional insureds and it grants you that waiver. Ask to see the endorsement on their policy for proof that their policy actually includes this coverage. Part of this responsibility lies on your agent or broker because they are the primary issuer of you certificates, and if they are writing in coverages that you don't actually have, it could get them in big trouble with their Errors and Omissions carrier, and potentially leave you with an unpaid claim. If your agent is doing this, we'd be happy to be your new agent.

5. One last thing suggestion that applies to both Additional Insured and Waivers of Subrogation. If you don't have it already, get both of these coverage added to your policy in a Blanket form and/or "when required by written contract". There are two reasons for this. 1. You don't have to worry about adding separate endorsements to your policy every time you grant additional insured status to another party you're contracting with. 2. It's cheaper and easier to buy a blanket Waiver of Subrogation, than it is to buy it on a project by project basis. By adding these endorsements in a blanket format, it also eliminates the possibility that you forget to call your insurance carrier or agent to have separate parties added for a specific project which could leave you with either an uninsured claim, a breach of contract, or both.

If you love certificates as much as we do, here's a great resource on best practices and suggestions for compliance.

Sorry for laying all this on you on a Monday morning. Give us a call if we can help clarify, or if you need help getting your certificates and risk transfer system working more efficiently.

Posted by Dan Phelan on Fri, Apr 29, 2011 @ 09:41 AM

What is a waiver of subrogation? You've seen this in construction contracts, on certificates, and many of your insurance policies have it, what what exactly is a Waiver of Subrogation and what does it do? A waiver of subrogation, also known as a "transfer of rights of recovery" is a mechanism that insurers use to transfer risk and to limit the rights of recovery from another party on behalf of the insured. Confused? An example of how a "Waiver of Subrogation" would work in a workers' comp claim scenario is this:

What is a waiver of subrogation? You've seen this in construction contracts, on certificates, and many of your insurance policies have it, what what exactly is a Waiver of Subrogation and what does it do? A waiver of subrogation, also known as a "transfer of rights of recovery" is a mechanism that insurers use to transfer risk and to limit the rights of recovery from another party on behalf of the insured. Confused? An example of how a "Waiver of Subrogation" would work in a workers' comp claim scenario is this:

A laborer at ABC HVAC is on XYZ General Contracting's site. ABC's laborer is injured because a piece of wood wasn't cleaned up by one of XYZ's workers. ABC's injured worker collects workers compensation for his injury, but because a waiver of subrogation was in place, ABC's insurance carrier can not go after XYZ's insurance limits to get the money they spent on the claim due to XYZ's negligence in maintaining the job site. Because ABC’s worker was injured, and ABC’s insurance carrier is on the hook for 100% of the medical and indemnity costs of the claim, ABC HVAC’s experience modification factor will increase, as well their workers compensation costs for the next three years. Depending on what ABC’s experience mod was prior to the claim, this spike could also hurt their ability to bid jobs requiring an experience mod lower than 1.00.

If a waiver of subrogation were not in place, ABC's insurance carrier could have subrogated back to XYZ's insurance carrier and make them pay the percentage of the claim that they were responsible for. This would have minimized the expense costs for ABC’s workers comp carrier, as well as minimized the effect that the claim had on ABC’s experience mod.

A popular misconception by many upstream contractors is that they are insulating themselves from liability downstream by requiring their subcontractors to provide a waiver of subrogation in their favor. While they are insulating themselves from the workers compensation insurance carriers of their subs, they are not insulated from having a suit brought by the injured worker and his/her family. Also, depending on the level of negligence by the upstream party, their general liability policy could be called upon to pay both defense costs as well as a settlement.

One last thing to consider about risk management and waivers of subrogation. There are two ways to obtain this coverage endorsement. It can be added to your policy for an annual fee, or can be obtained on a one off basis whenever required by contract. We advise our clients to have it built into their policy so that there isn't a possibility that they are in breach of contract by forgetting to have it endorsed separately for every job requiring it.

Want to get technical? Great article on IRMI.com about WOS here

If you missed our post about it last week, this blog as well as many others related to construction and contracting are available on Mike Rowe's Trades Hub.

Do you love workers compensation as much as we do? Here's the rest of our blog posts about it!

Have a question about your construction risk management program that we haven't answered on the blog yet? Ask a Risk Advisor!

Posted by Dan Phelan on Tue, Jan 04, 2011 @ 08:00 AM

Most general contractors worth their salt require all of their subcontractors to list them as additional insured (AI). But not all additional insured endorsements are created equal, in both coverage and time elements. Just because a sub sends you a certificate of insurance listing you(the GC) as additional insured does not mean that you are additionally insured for the types of coverage or timeframes you are requiring in your contracts. Some additional insured endorsements provide automatic coverage when a written contract is signed, some need to be separately added to their policy, some cover completed operations, some cover the owner, some cover engineers/architects...and some don't. Having the phrase "ABC Construction is listed as additional insured" on a cert can be a completely worthless statement if the sub's actual endorsement will not respond in the ways it is required to in your contract.

Most general contractors worth their salt require all of their subcontractors to list them as additional insured (AI). But not all additional insured endorsements are created equal, in both coverage and time elements. Just because a sub sends you a certificate of insurance listing you(the GC) as additional insured does not mean that you are additionally insured for the types of coverage or timeframes you are requiring in your contracts. Some additional insured endorsements provide automatic coverage when a written contract is signed, some need to be separately added to their policy, some cover completed operations, some cover the owner, some cover engineers/architects...and some don't. Having the phrase "ABC Construction is listed as additional insured" on a cert can be a completely worthless statement if the sub's actual endorsement will not respond in the ways it is required to in your contract.

This can be a problem for both the general contractor and the subcontractor. For the sub, if they don't have the proper AI endorsement as required by contract and a claim arises naming them as wholly or partially responsible, they will be both in breach of contract as well as uninsured for the claim. You, the GC, will not have access to the sub's limits because their insurance policy doesn't have the correct coverage to respond to that claim because the GC was never actually an additional insured. Long story short, they could potentially pay their portion of the claim out of pocket, and the GC will have to use their own insurance limits instead of the responsible partys'. This is a hypothetical scenario, but one that will become more prevalent as the complexity of contracts increase and lawyers become more adept at deciphering contract language.

What can you do to ensure the subs working on your jobs are in compliance with your contracts?

- Work with your insurance broker and lawyer to rewrite your standard contract with wording that reflects current language used in insurance policies

- Decide on which additional insured endorsement you will require your subs to have. Preferably one that affords coverage for ongoing AND completed operations

- REQUIRE all subs to attach a copy of their additional insured endorsement to their certificates of insurance

- Ask your agent which other AI endorsements afford equal or better coverage to the one you are requiring, because someone at your company will have to crosscheck the endorsements from subs against the endorsement you require in your contract

Will this add more paperwork for your staff? Yes and No. (unplug the fax machine and embrace technology. Computers can make this process much, much, much faster and easier)

Does this make recordkeeping more time consuming? Yes. (make a file on your computer for each job and each sub that works for you, and start mandating that all certs be emailed in PDF form)

Does this help strengthen your risk management program to guard your construction company against uninsured claims and lawsuits? YES.

And if you're a general contractor that isn't requiring your subs to list you as additional insured, please call as ASAP.

Posted by Dan Phelan on Mon, Jan 03, 2011 @ 07:21 AM

FYI:

FYI:

You don't have to give additional insured (AI) status to every General Contractor or Owner you are working for.

In the last few years, it has become commonplace for many subcontractors to be required to afford additional insured status to the upstream parties they are contracting with. Many do this without even having it in the insurance requirements in the contract they signed! When you give another party additional insured status on your policy, you are giving them access to your insurance limits on your General Liability, Business Auto, and Umbrella policies. In our humble opinion, it's not a prudent risk managment strategy to unnecessarily give other parties access to your insurance policy if you don't have to, yet time and time again we see it happening. You only have so many insurance dollars to pay a claim each year, don't let the claims of others erode your limits to the point where you will not have coverage for a serious claim!

Let's address this issue from another angle. Not all additional insured endorsements afford the same provisions to the upstream party requiring it, and depending on which insurance carrier you have the bulk of your coverage with, will determine which type of additional insured endorsement you have on your policies. Some endorsements will expose your limits more significantly than others, especially as it pertains to completed operations. If you are working for a savvy upstream party, they are probably going to ask you for completed operations coverage, since it keeps them covered for your mistakes even after you've been paid and have left the job. Some older versions of the standard commercial general liability additional insured endorsement provide this coverage through somewhat sloppy wording and some newer versions completely exclude it.

So what happens if you signed a contract and named another party as an AI, but don't actually have completed operations coverage on your additional insured endorsement and there is a claim that your company is named as a part of a year after you were off the job? First off, you are in breach of contract because you signed off on a coverage you didn't actually have. Secondly, your insurance carrier has no obligation to pay a claim that your policy was not built to respond to. This doesn't mean that you are off the hook and free to bid your next project. This means that your construction company is on the hook for whatever portion of that claim has been apportioned to you. This also means you'll be needing an expensive lawyer and will be getting your company checkbook out to clear this up.

How to fix this and make sure you're in compliance with all the contracts you're signing? Find an insurance broker that understands the complexities of construction insurance, knows how to read a construction contract, and can advise you on what type of additional insured endorsement is best for your company. To reiterate, just because you named another party as AI on your certificate of insurance, does not mean that you are in compliance with the contract you signed.

Things to check on your policy ASAP:

- The additional insured endorsement on your policy grants "blanked additional insured status when required by written contract"

- If the contracts you sign are requiring "completed operations", make sure your endorsement has this provision built into it

- If a contract mentions a specific AI endorsement, double check with your broker that your endorsement carries at least the equivalent amount of coverage as the one in the contract.

Posted by Dan Phelan on Wed, Sep 29, 2010 @ 07:52 AM

Insurance is expensive. Whether Geico saves you 15% or you had a few losses last year and your premium was increased 15%, you're probably still thinking that insurance is too expensive. The perception of many commercial construction insurance buyers is that if they "shop around" their insurance, they will be able to find a cheaper rate. While this CAN be a way to achieve your goal of getting cheaper insurance, let's look at a few of the pitfalls of this mindset. For this example, let's say ABC contractor is a carpenter that has been working as a sole proprietor and up to this point has only carried Commerical General Liability. However, he just got the opportunity to bid on a $50,000 job and the upstream party(owner or General Contractor) is requiring that he carry workers compensation. This insurance coverage hasn't been necessary for any jobs he has done in the past, and whenever he needed assistance on a job, he just called up one of his buddies and paid them under the table for their services. Yes, we in the insurance industry are well aware of this practice, and have a general understanding of what type of labor is necessary to complete certain aspects of a construction project. Anyways, so now you know you are going to have to carry workers compensation, as well as legally pay your helper/employee. Because you're inundated by PERSONAL insurance marketing whenever you turn on your TV, your gut reaction is to pick up the phone or hop on the internet to get as many quotes as you can without ever considering whether the insurance agents and brokers you are calling know a thing about Connecticut construction insurance. So now you've got a few live insurance people in the phone and are getting multiple quotes from different agents for different lines of coverage.

Insurance is expensive. Whether Geico saves you 15% or you had a few losses last year and your premium was increased 15%, you're probably still thinking that insurance is too expensive. The perception of many commercial construction insurance buyers is that if they "shop around" their insurance, they will be able to find a cheaper rate. While this CAN be a way to achieve your goal of getting cheaper insurance, let's look at a few of the pitfalls of this mindset. For this example, let's say ABC contractor is a carpenter that has been working as a sole proprietor and up to this point has only carried Commerical General Liability. However, he just got the opportunity to bid on a $50,000 job and the upstream party(owner or General Contractor) is requiring that he carry workers compensation. This insurance coverage hasn't been necessary for any jobs he has done in the past, and whenever he needed assistance on a job, he just called up one of his buddies and paid them under the table for their services. Yes, we in the insurance industry are well aware of this practice, and have a general understanding of what type of labor is necessary to complete certain aspects of a construction project. Anyways, so now you know you are going to have to carry workers compensation, as well as legally pay your helper/employee. Because you're inundated by PERSONAL insurance marketing whenever you turn on your TV, your gut reaction is to pick up the phone or hop on the internet to get as many quotes as you can without ever considering whether the insurance agents and brokers you are calling know a thing about Connecticut construction insurance. So now you've got a few live insurance people in the phone and are getting multiple quotes from different agents for different lines of coverage.

What happens when you need a certificate of insurance?

1. You call BOTH of your agents (because they were able to get cheap quotes, but not for both GL and Comp)

2. Both of these agents either fax, email, or snail mail the certificate to the certificate holder (now the receiving party has to coordinate the filing of multiple certs, arriving at different times. AKA a pain in the ass for the owner/GC you're working for and is PAYING you)

3. Did you read your contract? Does it require you to maintain your General Liability coverage for several years after the completion of the project. (Hint: most commercial construction contracts have this requirement) Now, for 3-7 years following the completion of this job you will be required to send certs to the certificate holder for the next few years at the time your insurance renews. Multiple agents, sending multiple certificates for multiple years is a poor risk management strategy. If you don't send these certificates, and have a complete operations claim, you will be in breach on contract and whichever insurance carrier issued your policy, is no longer required to pay your claim.

This is a reality. This kind of claim happens often. Will it be worth paying 20 grand out of YOUR pocket to save $80 dollars on your insurance policy?

If that 80$ is more important that keeping your doors open, please use the yellow pages to find coverage. If you want a policy that covers your construction company correctly and makes it easy for General Contractors and Owners to work with you, Call Us.

Posted by Robert Phelan on Tue, Dec 22, 2009 @ 09:03 AM

The job of an insurance agent/broker is to sell insurance policies on behalf of the insurance companies they represent. Even worse, 95% of them are generalists who are only partially dedicated to the construction industry. This means that if you are relying on them to help you with COI administration, don't hold your breath.

A specialized Risk Advisor, dedicated to the construction industry is a different animal. They are a pro-active service provider who understands COI administration in minute detail. If you were to engage one of them, this is the process they would help you implement:

• If you are an upstream party, they would work with you and your legal counsel to be sure you've transferred downstream as much risk as possible

• They would also help you keep your contract current with legal developments in your jurisdiction as well as insurance coverage enhancements and changes

• If you are a downstream party, they would either read or train someone on your staff to read the insurance specifications on every job you bid, and advise what to agree to as well as push-back on

• They would make sure that the coverage you have is adequate to comply with the types of contracts you are signing

If you are an upstream party, they would provide you with the "Perfect COI". This would be a sample COI you provide to all subcontractors and sub-subs to show them exactly how you want the COI to read along with any attachments required (additional insured endorsements, waiver of subrogation, copy of specialty coverage policy, etc.)

Lastly, they would teach someone at your construction firm the process of checking every Certificate of Insurance for as long as the downstream party is obligated to you. This is the final element without which all the others are meaningless. It is also the fourth and final "C" in the C4 process and the subject of my next post.

Posted by Robert Phelan on Mon, Dec 21, 2009 @ 08:04 AM

You really don't want to hear this but I won't be of any use to you if I don't tell it straight. There are three reasons that COIs don't work well for the construction industry:

Ignorance

Laziness

Weak COI Administration

Ignorance - Every party to the COI is ignorant in one way or another.

The lawyers who draft the insurance language that goes in the job specifications and contract are ignorant about the nuances of insurance coverage and many times use antiquated or inappropriate language

Insurance underwriters think that their clients have perfect insurance administration systems

Insurance agents, who are often generalists, don't begin to understand the intricacies of the specific coverage forms required in construction contracts

Upstream owners and contractors don't understand what they should be looking for when they receive a COI

Downstream subs and sub-subs don't know really know if the COI they are sending upstream accurately reflects their true coverage or whether it's what the contract requires

Laziness -

All parties are lazy about changing a system they don't realize is broke.You,the contractor, can't be lazy any longer! Got it? This little piece of paper called a Certificate of Insurance (COI) can mean the difference between staying in business and shutting the doors. You have to figure out what it (the COI) means and how to administer them (all the COIs you send or receive) or be prepared to keep the $$ around to pay an uninsured claim.

Weak COI Administration - It's rare to find a contractor with a bulletproof system

In most construction firms, this amounts to nothing more than attaching whatever COI is provided (by a downstream party) to the appropriate contract and making sure that the coverage is renewed for as long as the job remains active. This doesn't cut it any more.

In the next post I'll describe the ideal COI administration system that a Risk Advisor would implement with you.

Read part 1 of our 3 part series on COIs

Posted by Robert Phelan on Fri, Dec 18, 2009 @ 10:03 AM

In its simplest form, a COI is a single sheet document that describes the insurance  coverage of a contractor. It includes such details as the insurance carrier(s), policy term, limits of coverage, the agent providing the coverage, notice of cancellation provisions and other pertinent coverage details.

coverage of a contractor. It includes such details as the insurance carrier(s), policy term, limits of coverage, the agent providing the coverage, notice of cancellation provisions and other pertinent coverage details.

Unfortunately, insurance policies have become very complex documents and it is impossible to represent them properly on a single sheet of paper. (As I wrote that last sentence, I realized that maybe that's the problem. The COI form has not kept pace with the complexity of construction contracts.)

Maybe at this point you say, "Big Deal! I've been providing/receiving COIs forever and it hasn't hurt me yet." I'll promise you this. It will if you don't change and you should care because your business is at stake. Giving or receiving a bad COI is like the iceberg was to the Titanic. By the time the problem is spotted, the disaster (uncovered claim) has already occurred.

Here's what a COI won't tell you:

- Whether one or more of the insurance companies being used is financially unsound

- Almost 100% of the time, one or more parties are required to be added as Additional Insureds on one or more policies. In most cases, a COI won't tell you if the right Additional Insured endorsement has been used. There used to be one or two of these endorsements. Now there are dozens.

- If coverage is required to be kept in place for one or more years after project completion and you don't get a new COI every year, you won't know if the party providing the COI has maintained the required coverage.

- Specialty coverages like pollution, professional and builders risk are all written on non-standard forms. A simple COI tells you nothing other than the limit. The limit is meaningless if the coverage is non-existent due to exclusions.

- Lastly, but maybe most importantly, nothing on the COI will tell you whether the coverage is in compliance with the contract specification. Only a trained human being can tell you that.

In my next post I'll describe the three reasons all contractors struggle with COIs.

Posted by Robert Phelan on Thu, Dec 17, 2009 @ 07:42 AM

Let's say you've done everything right. Let's say you've got all the coverage you need for upstream parties and your specifications to downstream parties spell out exactly what is required by of them. Most contractors think their job is over. All they have to do is keep a current COI on file (upstream or downstream) until project completion. Far from it but this is where the system breaks down. Most contractors have no one on their staff that is trained to "Check" a COI to be sure it matches the requirements in the contract.

What if the insurance carrier(s) is changed and the new one has financial problems?

What if limits are changed?

What if the Additional Insureds are left off the renewal policy?

What if specialty coverage is discontinued?

What if coverage has to be maintained for three years and you stop checking after job completion?

What if your sub didn't even read the spec and just gave you their standard COI? Would you even know?

What if you misread the spec (or your agent did) and you're providing the wrong coverage to an upstream party?

What if you change carriers and you don't realize that the new (and cheaper) coverage isn't as broad as what you had before?

There are lots of "What ifs"; any one of which could be disastrous to your business. So why does no one pay attention to this critical element? Because it takes discipline, consistency, education and training to manage COIs properly.

Most contractors think that all COIs are created equal. That as long as they have the COI they're all set. If something bad happens and the sub doesn't have the right coverage, you can sue them and recover. Maybe. For a serious uninsured claim, the sub won't have millions in their checking account even if you prove them wrong.

Building a process to make COI administration bulletproof does not have to be difficult or intimidating. A Risk Advisor can assist you, guide you or train you to execute flawlessly. Contact us today to learn more.

Posted by Robert Phelan on Fri, Dec 11, 2009 @ 08:33 AM

Continued from Yesterday...

Your back is against the wall. As The GC, you are clearly responsible for this school being shut down and now there is $6 to $10 million of damage and expense that you've got to pay. But wait. It was the sub who installed the windows who really caused the problem. You're off the hook after all. You get your contract administration people to bring you the sub's contract along with their Certificate of Insurance (COI). Relief is in sight.

You review the documents and you see that the COI shows that the sub carried pollution coverage. Whew! They also agreed to hold you harmless. There's light at the end of the tunnel. You pump up your chest and feel good that you're so smart to have the right procedures in place to transfer liability to others.

You ask your attorney to send a letter to the sub asking them to report the claim to their carrier and telling them you expect full indemnification just as they agreed to in the contract. You sub sends a letter back that provides these distressing facts:

• The COI being referenced reflected the sub's coverage at the time they completed their work. That was two years ago.

• They didn't know they had to maintain the pollution coverage. No other job required it so they non-renewed and saved $22,000 per year.

• This tough economy has hit them hard. The 40 man crew they carried on the school project is down to 5 and if they don't get a job soon, they'll be shutting down. They have no money and can't indemnify you the GC.

Certificates of Insurance can be your friend when managed properly. When managed sloppily, your company can sink as quickly as the Titanic.

If you had notified the sub at the end of the job that they had to maintain the pollution coverage for three years and then monitored them by getting a new COI each year, you might have had a chance at survival. Since they have no coverage, you have no coverage and you would come up a little short paying $6 to $10 million form your checkbook, you're out of business. Fifty years of hard work gone because you lacked a simple administrative procedure. A good Risk Advisor would have helped you fix this blind side before your company was forced out of business.