Posted by Dan Phelan on Mon, Aug 22, 2011 @ 09:45 AM

Certificates of Insurance updates and suggestions. Please take all commentary with a grain of salt depending on the state you perform work in, and because there are exceptions to the majority of what I wrote below...

1. If an upstream party has a 10 million dollar umbrella, and expects all their subs to carry limits equal to or in excess than that, they need to be flexible about changing subcontracts to reflect a realistic limit requirement that smaller subcontractors carry. We've found this to be a fairly easy push back when our subs are being asked to carry limits that are excessively high for the type of work they do, or their scope of work for a particular project. If you don't push back, and have a large claim, there can be severe breach of contract problems because you are out of compliance with what you signed.

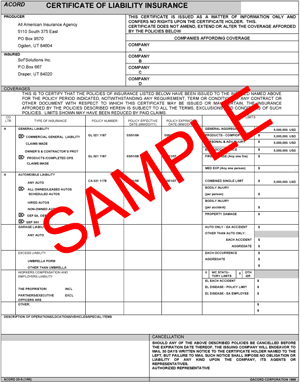

2. The standard Acord certificate of insurance has been updated. There are no more endeaver to's, or 10, 30, 60, or 90 day notice of cancellation fields. If you're the upstream party, request the downstream party to attach the endorsement on their policy that states their policy's cancellation clause. Check with your agent/lawyer, and have them update the sample certificate you provide your subs with to comply with the new industry standard version. The insurance industry is still working out some of the kinks, and this gets complicated because different states have different reporting periods. Sometimes they can even be different for each line of coverage, so check with your agent. One big thing to remember, is that the only entity that will be informed of this cancelation is the 1st named insured, usually the cert holder. So if you have a description of ops listing 15 gov't entities, LLCs, holding companies, architects, owners, and whomever else, the only one that is getting a notification of cancelation is the company whose name is in the cert holder field.

3. Additional Insured. If your subcontractors are naming or listing your company as additional insured in the description of ops, do not assume that you are an additional insured without asking for a copy of the AI endorsement on your sub's GL, Auto, and Umbrella policies. And in CT at least, you cannot be added as additional insured on your sub's work comp policy so stop asking!

4. Waiver of Subrogation. Just like with additional insured status, a sub can't just write in the description of ops that a waiver of subrogation applies in favor of additional insureds and it grants you that waiver. Ask to see the endorsement on their policy for proof that their policy actually includes this coverage. Part of this responsibility lies on your agent or broker because they are the primary issuer of you certificates, and if they are writing in coverages that you don't actually have, it could get them in big trouble with their Errors and Omissions carrier, and potentially leave you with an unpaid claim. If your agent is doing this, we'd be happy to be your new agent.

5. One last thing suggestion that applies to both Additional Insured and Waivers of Subrogation. If you don't have it already, get both of these coverage added to your policy in a Blanket form and/or "when required by written contract". There are two reasons for this. 1. You don't have to worry about adding separate endorsements to your policy every time you grant additional insured status to another party you're contracting with. 2. It's cheaper and easier to buy a blanket Waiver of Subrogation, than it is to buy it on a project by project basis. By adding these endorsements in a blanket format, it also eliminates the possibility that you forget to call your insurance carrier or agent to have separate parties added for a specific project which could leave you with either an uninsured claim, a breach of contract, or both.

If you love certificates as much as we do, here's a great resource on best practices and suggestions for compliance.

Sorry for laying all this on you on a Monday morning. Give us a call if we can help clarify, or if you need help getting your certificates and risk transfer system working more efficiently.

Posted by Dan Phelan on Fri, Apr 29, 2011 @ 09:41 AM

What is a waiver of subrogation? You've seen this in construction contracts, on certificates, and many of your insurance policies have it, what what exactly is a Waiver of Subrogation and what does it do? A waiver of subrogation, also known as a "transfer of rights of recovery" is a mechanism that insurers use to transfer risk and to limit the rights of recovery from another party on behalf of the insured. Confused? An example of how a "Waiver of Subrogation" would work in a workers' comp claim scenario is this:

What is a waiver of subrogation? You've seen this in construction contracts, on certificates, and many of your insurance policies have it, what what exactly is a Waiver of Subrogation and what does it do? A waiver of subrogation, also known as a "transfer of rights of recovery" is a mechanism that insurers use to transfer risk and to limit the rights of recovery from another party on behalf of the insured. Confused? An example of how a "Waiver of Subrogation" would work in a workers' comp claim scenario is this:

A laborer at ABC HVAC is on XYZ General Contracting's site. ABC's laborer is injured because a piece of wood wasn't cleaned up by one of XYZ's workers. ABC's injured worker collects workers compensation for his injury, but because a waiver of subrogation was in place, ABC's insurance carrier can not go after XYZ's insurance limits to get the money they spent on the claim due to XYZ's negligence in maintaining the job site. Because ABC’s worker was injured, and ABC’s insurance carrier is on the hook for 100% of the medical and indemnity costs of the claim, ABC HVAC’s experience modification factor will increase, as well their workers compensation costs for the next three years. Depending on what ABC’s experience mod was prior to the claim, this spike could also hurt their ability to bid jobs requiring an experience mod lower than 1.00.

If a waiver of subrogation were not in place, ABC's insurance carrier could have subrogated back to XYZ's insurance carrier and make them pay the percentage of the claim that they were responsible for. This would have minimized the expense costs for ABC’s workers comp carrier, as well as minimized the effect that the claim had on ABC’s experience mod.

A popular misconception by many upstream contractors is that they are insulating themselves from liability downstream by requiring their subcontractors to provide a waiver of subrogation in their favor. While they are insulating themselves from the workers compensation insurance carriers of their subs, they are not insulated from having a suit brought by the injured worker and his/her family. Also, depending on the level of negligence by the upstream party, their general liability policy could be called upon to pay both defense costs as well as a settlement.

One last thing to consider about risk management and waivers of subrogation. There are two ways to obtain this coverage endorsement. It can be added to your policy for an annual fee, or can be obtained on a one off basis whenever required by contract. We advise our clients to have it built into their policy so that there isn't a possibility that they are in breach of contract by forgetting to have it endorsed separately for every job requiring it.

Want to get technical? Great article on IRMI.com about WOS here

If you missed our post about it last week, this blog as well as many others related to construction and contracting are available on Mike Rowe's Trades Hub.

Do you love workers compensation as much as we do? Here's the rest of our blog posts about it!

Have a question about your construction risk management program that we haven't answered on the blog yet? Ask a Risk Advisor!

Posted by Dan Phelan on Fri, Mar 11, 2011 @ 08:44 AM

Article from IRMI Risk Management

Court Reiterates Need To Complete Contracts BEFORE Starting Work

Most contractors have heard on more than one occasion how important it is to execute a signed contract before starting work on a project. Failure to do so can result in a variety of contract claims and insurance coverage gaps. One unfortunate contractor just learned that lesson the hard way.

In Zurich Am. Ins. Co. v. Illinois Nat'l Ins. Co., No. 105533/09, 2010 N.Y. Misc. LEXIS 6332 (N.Y. Sup. Ct. N.Y. Cty., Dec. 23, 2010), the Supreme Court of New York ruled that an excavation subcontractor who started work on a project before the contract was signed did not meet the definition of an "insured" under the wrap-up policy covering the project with respect to losses that occurred prior to enrollment. The OCIP policy defined "named insured" to include "[a]ll contractors and/or subcontractors and/or subconsultants for whom the owner or the owner's agents are responsible to arrange insurance to the extent of their respective rights and interests." However, it further defined "contractor" to include parties "who have executed a written agreement pertaining to said Contractors' performance of work at the Project Site, have been enrolled in the insurance program, and who perform operations at the Project site in connection with the Project."

The subcontractor (and its insurer, Zurich) argued that it was not unusual for construction firms to begin work while the paperwork is in process, and that its delay in getting the OCIP paperwork completed should not defeat the parties' intent that it would be covered by the wrap-up for its work on the project. The court rejected that argument, holding that the subcontractor's coverage under the wrap-up policy did not begin until the subcontract was signed and enrollment in the wrap-up was completed. There was, therefore, no coverage for pre-enrollment losses.

While this case was decided in New York, it serves as a reminder for contractors everywhere of the importance of getting the paperwork completed before bringing workers onto a project.

Whether your construction firm is working on a wrap up or not, it's important to always make sure the ink has dried on the contract prior to sending your employees and equipment to the job site. This lawsuit will be precedent setting, and in these trying economic times, it would be foolhardy to have an uninsured claim because of haste to get on a job site. Give us a call with any of your contract questions at 1-800-252-9864

Posted by Dan Phelan on Tue, Jan 04, 2011 @ 08:00 AM

Most general contractors worth their salt require all of their subcontractors to list them as additional insured (AI). But not all additional insured endorsements are created equal, in both coverage and time elements. Just because a sub sends you a certificate of insurance listing you(the GC) as additional insured does not mean that you are additionally insured for the types of coverage or timeframes you are requiring in your contracts. Some additional insured endorsements provide automatic coverage when a written contract is signed, some need to be separately added to their policy, some cover completed operations, some cover the owner, some cover engineers/architects...and some don't. Having the phrase "ABC Construction is listed as additional insured" on a cert can be a completely worthless statement if the sub's actual endorsement will not respond in the ways it is required to in your contract.

Most general contractors worth their salt require all of their subcontractors to list them as additional insured (AI). But not all additional insured endorsements are created equal, in both coverage and time elements. Just because a sub sends you a certificate of insurance listing you(the GC) as additional insured does not mean that you are additionally insured for the types of coverage or timeframes you are requiring in your contracts. Some additional insured endorsements provide automatic coverage when a written contract is signed, some need to be separately added to their policy, some cover completed operations, some cover the owner, some cover engineers/architects...and some don't. Having the phrase "ABC Construction is listed as additional insured" on a cert can be a completely worthless statement if the sub's actual endorsement will not respond in the ways it is required to in your contract.

This can be a problem for both the general contractor and the subcontractor. For the sub, if they don't have the proper AI endorsement as required by contract and a claim arises naming them as wholly or partially responsible, they will be both in breach of contract as well as uninsured for the claim. You, the GC, will not have access to the sub's limits because their insurance policy doesn't have the correct coverage to respond to that claim because the GC was never actually an additional insured. Long story short, they could potentially pay their portion of the claim out of pocket, and the GC will have to use their own insurance limits instead of the responsible partys'. This is a hypothetical scenario, but one that will become more prevalent as the complexity of contracts increase and lawyers become more adept at deciphering contract language.

What can you do to ensure the subs working on your jobs are in compliance with your contracts?

- Work with your insurance broker and lawyer to rewrite your standard contract with wording that reflects current language used in insurance policies

- Decide on which additional insured endorsement you will require your subs to have. Preferably one that affords coverage for ongoing AND completed operations

- REQUIRE all subs to attach a copy of their additional insured endorsement to their certificates of insurance

- Ask your agent which other AI endorsements afford equal or better coverage to the one you are requiring, because someone at your company will have to crosscheck the endorsements from subs against the endorsement you require in your contract

Will this add more paperwork for your staff? Yes and No. (unplug the fax machine and embrace technology. Computers can make this process much, much, much faster and easier)

Does this make recordkeeping more time consuming? Yes. (make a file on your computer for each job and each sub that works for you, and start mandating that all certs be emailed in PDF form)

Does this help strengthen your risk management program to guard your construction company against uninsured claims and lawsuits? YES.

And if you're a general contractor that isn't requiring your subs to list you as additional insured, please call as ASAP.

Posted by Dan Phelan on Mon, Jan 03, 2011 @ 07:21 AM

FYI:

FYI:

You don't have to give additional insured (AI) status to every General Contractor or Owner you are working for.

In the last few years, it has become commonplace for many subcontractors to be required to afford additional insured status to the upstream parties they are contracting with. Many do this without even having it in the insurance requirements in the contract they signed! When you give another party additional insured status on your policy, you are giving them access to your insurance limits on your General Liability, Business Auto, and Umbrella policies. In our humble opinion, it's not a prudent risk managment strategy to unnecessarily give other parties access to your insurance policy if you don't have to, yet time and time again we see it happening. You only have so many insurance dollars to pay a claim each year, don't let the claims of others erode your limits to the point where you will not have coverage for a serious claim!

Let's address this issue from another angle. Not all additional insured endorsements afford the same provisions to the upstream party requiring it, and depending on which insurance carrier you have the bulk of your coverage with, will determine which type of additional insured endorsement you have on your policies. Some endorsements will expose your limits more significantly than others, especially as it pertains to completed operations. If you are working for a savvy upstream party, they are probably going to ask you for completed operations coverage, since it keeps them covered for your mistakes even after you've been paid and have left the job. Some older versions of the standard commercial general liability additional insured endorsement provide this coverage through somewhat sloppy wording and some newer versions completely exclude it.

So what happens if you signed a contract and named another party as an AI, but don't actually have completed operations coverage on your additional insured endorsement and there is a claim that your company is named as a part of a year after you were off the job? First off, you are in breach of contract because you signed off on a coverage you didn't actually have. Secondly, your insurance carrier has no obligation to pay a claim that your policy was not built to respond to. This doesn't mean that you are off the hook and free to bid your next project. This means that your construction company is on the hook for whatever portion of that claim has been apportioned to you. This also means you'll be needing an expensive lawyer and will be getting your company checkbook out to clear this up.

How to fix this and make sure you're in compliance with all the contracts you're signing? Find an insurance broker that understands the complexities of construction insurance, knows how to read a construction contract, and can advise you on what type of additional insured endorsement is best for your company. To reiterate, just because you named another party as AI on your certificate of insurance, does not mean that you are in compliance with the contract you signed.

Things to check on your policy ASAP:

- The additional insured endorsement on your policy grants "blanked additional insured status when required by written contract"

- If the contracts you sign are requiring "completed operations", make sure your endorsement has this provision built into it

- If a contract mentions a specific AI endorsement, double check with your broker that your endorsement carries at least the equivalent amount of coverage as the one in the contract.

Posted by Dan Phelan on Wed, Jun 30, 2010 @ 01:57 PM

If so, is your construction company in the CCR (Central Contractor Registry)? According to an article in the May/June issue of Commercial Construction Magazine, probably not. Of the 885,000 or so construction companies in the United States, just over 20,000(2%!) are listed and approved to bid on federal construction projects. Considering that the federal government spent close to $317 BILLION on construction last year, a whole lot of construction firms are missing out on a huge opportunity to receive ARRA construction money. The biggest gripe we hear when we engage new prospective clients is that bid lists are too long, and the winning bidder will probably lose money on the job and probably be out of business by 2011.

If so, is your construction company in the CCR (Central Contractor Registry)? According to an article in the May/June issue of Commercial Construction Magazine, probably not. Of the 885,000 or so construction companies in the United States, just over 20,000(2%!) are listed and approved to bid on federal construction projects. Considering that the federal government spent close to $317 BILLION on construction last year, a whole lot of construction firms are missing out on a huge opportunity to receive ARRA construction money. The biggest gripe we hear when we engage new prospective clients is that bid lists are too long, and the winning bidder will probably lose money on the job and probably be out of business by 2011.

The private sector of construction has dropped over 30% since 2006 and a dramatic rebound isn't in the cards yet, but Uncle Sam still has plenty of work for you on his roads, military bases, and large civil projects revolving around Hurrican and Storm Damage prevention. To find out how to get your name in the registry, and start bidding jobs with low competition, check out How To Be A Federal Construction Contractor.

If you do start winning Federal Construction Jobs, you'll realize that the Federal construction contractor insurance requirements you will be facing are slightly more in depth and complicated than what you and your insurance agent are probably used to. In addition to extra construction insurance coverages, you may also need to secure USL&H (Longshore Harbor Worker's Compensation Act)and acquire a Waiver of Governmental Immunity. Neither are easy to understand if you have never been required to have them before. Luckily, some of Construction Risk Advisor's clients do a considerable amount of Federal construction work and we have helped them navigate the complicated waters of procuring construction insurance quotes for Federal construction jobs.

Get yourself in the CCR (no, not Creedence Clearwater Revival) and get on the shortlist for winning some bids!

Posted by Robert Phelan on Thu, Apr 29, 2010 @ 01:54 PM

As I skimmed Saturday's Wall Street Journal, I saw a handsome couple featured in an ad for fractional jet ownership. The caption read, "Avantair allows us to be more productive and efficient as a law firm". My immediate thought was, "What kind of law firm uses a private jet?" I found the answer at their website.

They listed twelve settlements on their home page ranging from $350 million (United States record) all the way down to a measly $12 million. I guess that explains the jet as does the sub-header under their name, "Over $800 million in Verdicts and Recoveries". I believe that plaintiff's attorneys get 30-40% for their fee so on the conservative side that's $240 million. Not bad for a two person, husband and wife law firm!

You might think that your Connecticut construction company could never be exposed to the type of liability that would attract a law firm like this. Think again. Any business owner could go bankrupt tomorrow if they get on the wrong end of a lawsuit and lack the proper insurance coverage.

Here's a quick sampling of their settlements:

• $23.4 million against a drunk driver who killed three people. $13.5 million of the verdict was for punitive damages, uncovered by insurance. How certain are you that no one is ever drunk behind the wheel of one of your company vehicles?

• $25 million verdict for a man who fell while inspecting a building. Do you own any property? Could someone fall from a height of 12 feet? That's what happened here. (The verdict was in 1998. What would it be worth in 2010? $50 million?)

• $12 million for amputations due to electric shock

• In Miami-Dade County, Florida a jury awarded a 78-year-old woman and her husband $20.98 million for the injuries that she suffered in a car crash that left her on a ventilator for live. The plaintiff sued the driver and the driver's employer. The woman's attorneys successfully argued that the defendant driver was so distracted that he made no attempt to stop and slammed into the rear of the woman's car. After subpoenaing the employee driver's cell phone records they proved that he had been on the cell phone talking at the time. The case settled for $16.1 million five days after the verdict.

Connecticut construction company owners can't think they are immune from the liability described in the suits above. If you own property and you have employees and you own vehicles and equipment, you have the potential for a devastating lawsuit.

You need to change your buying criteria for insurance today. Contractors tend to go for the "fools gold" of cheap insurance. Don't you do that! You've worked hard to build your construction company. Get a good advisor and protect it with the right insurance coverage.

Posted by Robert Phelan on Fri, Apr 23, 2010 @ 06:56 AM

In my last post, I talked about finding the Hulk Hogan of insurance agents. To be more formal, you want a CRO or Chief Risk Officer. Since you probably don't have one on staff, you've got to find one and make him or her one of your Trusted Advisors.

Construction risk management has become a field unto itself. There is probably no more complicated area of insurance than insurance for contractors. The best practitioners are all specialists. It has become impossible to dabble in construction insurance. It's a full time job and you need the best.

It's a down economy, bid lists are long and all that "stimulus" money must have ended up in someone else's checkbook. So I'm not suggesting that you create a new position in your company just for insurance. I am suggesting that you outsource the risk management function to someone who has the skills and training to be your CRO. That is definitely not your typical insurance agent, mainly trained to sell you insurance policies.

Why is this so important? Think about the way you manage risk now. If you're like most of your peers, you've given "insurance buying" responsibilities to either someone on your finance staff or someone in the HR function. Even though their responsibility is limited to managing your insurance, they haven't even been trained to do that much less be your internal CRO. Do you really think that having a part time, overworked insurance buyer with no formal training is the best way to protect your business from catastrophic loss? I didn't think so.

You're probably thinking that you are paying your insurance agent to protect your business. Think again. First of all, most of them lack any level of training beyond what they learned to get a license. That's not very much when you consider half the curriculum was dedicated to homeowners and auto insurance and you can take the training in a week. If you want to see a deer in the headlights, ask your insurance agent if he is your CRO?

You're probably thinking that you are paying your insurance agent to protect your business. Think again. First of all, most of them lack any level of training beyond what they learned to get a license. That's not very much when you consider half the curriculum was dedicated to homeowners and auto insurance and you can take the training in a week. If you want to see a deer in the headlights, ask your insurance agent if he is your CRO?

Insurance protects the most valuable asset you own, your business. And you need more than just insurance in today's world. You need a full complement of risk management services and a talented team of people who can execute a plan to mitigate and manage the risks faced by your business. Cheap insurance managed part time or a crack risk management team looking out for you like a bodyguard.

You decide.

Posted by Robert Phelan on Tue, Apr 20, 2010 @ 07:54 AM

Returning from a business trip recently I was relaxing in the Delta Sky Club at Hartsfield International in Atlanta. As I sipped a soda and ate some pretzels, Hulk Hogan walked in with a small entourage. He looks the same in real life as on TV - as big as a mountain and a little older but the same guy, the same twelve-time world heavyweight champion. He's 56 years old but you wouldn't want to mess with him. He is still "winning" fights this year! Read about it on wikipedia

What does Hulk Hogan have to do with insurance for contractors? A lot, if you look at the world through my eyes.

If you ever needed a bodyguard, he's your man. Read his biography at the link above. He got in the ring with the biggest and the baddest and came out on top. He was the face of WWF(Now WWE). He is a winner and the world knows it. Hogan fought to the finish and intimidated other giants of the game. If I could choose a bodyguard, Hulk Hogan would be my first choice.

If you're a business owner, after protecting your life and family, your business would probably come next. For most construction company owners, their business is their most valuable asset. But surprisingly, I can almost guarantee, none of you know the biography of the person you have chosen to protect your business, your insurance agent or broker. Why is that? How could that be?

It's simple really. Contractors buy insurance the same way they operate in their own world - low bidders win. So instead of making insurance choices based on the capabilities of the people providing the service, they buy cheap insurance.

Do you really think there is no difference between a risk advisor with thirty years of experience and a trainee insurance agent with a cheap price? After all the hard work you've put into building your business, do you really want to entrust its protection to someone you've just met? Someone whose training and skills are unknown to you?

Insurance for contractors is as complex now as it has ever been. The risks you encounter can easily produce multi-million dollar liabilities. If your workers compensation claims aren't managed properly, your EMR (experience Mod Rate) can skyrocket and destroy your ability to compete.

Don't trust the protection of your business to just anyone. When you look across the desk the next time you make an insurance buying decision, ask yourself this: Is this the Hulk Hogan of insurance agents? If you have any doubt, reconsider. Your business depends on it.

Posted by Robert Phelan on Mon, Mar 15, 2010 @ 12:49 PM

Preventing Losses

Written by Robert Phelan

Can pro football offer lessons about how to run your construction business? Well, some of the challenges you face are much like those that face Coach Bill Belichick of the Patriots or Coach Tom Coughlin of the Giants.

Can pro football offer lessons about how to run your construction business? Well, some of the challenges you face are much like those that face Coach Bill Belichick of the Patriots or Coach Tom Coughlin of the Giants.

Like them, you have to protect your "blind side." Failing to do so can bring big losses on a football field and in your business.

In his book "The Blind Side," author Michael Lewis reveals how football strategy has changed over the past 25 years.

One player in particular spurred change. Lawrence Taylor - the legendary "LT" - was right linebacker and a feared defenseman who typically made quarterbacks shake in their cleats.

Taylor always said his mission was to "destroy" the quarterback - which he nearly did when he once broke two bones in Joe Theismann's leg in a famous Redskins game.

Most quarterbacks are right-handed, so their blind side is their left. When they turn their heads to follow their right arm, they can't see what's coming at them from the other side. If it happens to be Lawrence Taylor fast approaching, they need the best protection they can possibly have in the left tackle position.

Because of Taylor, the left tackle position on the offensive line suddenly became one of the most important positions on the team.

Meanwhile, Bill Walsh, coach of the San Francisco 49ers, built an offensive strategy based on short passes. Joe Montana and his successor, Steve Young, moved the ball down the field and won three Super Bowl championships with this new strategy. The key element was the ability of the left tackle - the best player on the offensive line - to protect the quarterback's blind side.

What's the lesson for your business? It's one that affects you every day when you bid on jobs and try to fulfill contracts you already have. You have to know that you have a blind side that contains all those risks that can potentially destroy your business. These risks that exist in our world today are bigger and more complex than ever before.

As a business owner, do you ever go to sleep at night staring up at the ceiling, wondering what's going to get through your "offensive line?" There's a world out there full of Lawrence Taylors ready to destroy your business. As you look out at your construction operations, you may see heavy equipment, workers exposed to extreme and stressful work environments, and fleets of automobiles and trucks on the highway every day, which are vulnerable to weather conditions and other drivers who are not paying attention. All of those things look like accidents waiting to happen.

In 2001, a salesperson working for a building supply wholesaler was talking on his cell phone while driving a pickup truck. He ran a stop sign and plowed into a vehicle, injuring a 78-year-old passenger. She sued the wholesaler, a large multistate company, and the jury ultimately awarded her $21 million. The company was insured, but it had much less than $21 million worth of liability insurance.

This is a frightening number for any company to see because probably all of

us have gotten distracted while driving. It just takes one moment and a catastrophe could wipe out a company built and sustained for generations.

Last year, a job site crew for one of my clients had just finished a safety meeting when the foreman, who was sitting in a loader and wasn't paying attention, dropped a bucket on another worker's leg. If it weren't for the quick response and medical attention he received, this worker probably would have lost his leg. It would have been a multimillion-dollar loss instead of a relatively quick recovery.

Another sobering example occurred when a bridge contractor had an employee working in an elevator shaft. He was their most experienced and safest employee. It was the end of his shift, and he thought to himself, "I just need to do one more task, take one more minute." He stretched himself beyond the safe zone and fell 30 or 40 feet down the elevator shaft, landing on his back and his legs, breaking the femurs in both legs. He would have been killed if there hadn't been loose pieces of plywood stacked in the bottom.

Everything you've worked for can vanish in a moment. It would only take one multimillion-dollar catastrophe to either leave your business with an uninsured loss or stuck with such exorbitant insurance premiums that you can't really compete anymore.

Force yourself to ask this question, "If one of our workers was involved in an automobile accident where someone was seriously hurt because the worker was texting on a cell phone, could I afford a $21 million jury verdict?"

When you have a serious accident, your workers' comp experience mod rate will soar. This is a number that compares your claims experience to other contractors of your type. If your mod rate is say, 2.0, your premiums will be twice as expensive as average. A high mod rate can put your construction company on the edge of viability.

So, who - or what - is your "left tackle?" Here are a couple real-life ideas:

First, it's an unremitting, 24/7 effort on safety. Hazards never sleep. Safety can't ever take a break, either. You have to create a safe culture. Some of the biggest companies, notably Turner Construction, have done an exemplary job with safety, striving to get as close as possible to zero losses. Small- and middle-market construction companies can do the same thing - and they must.

Second, it's having enough of the right kind of insurance, which becomes more affordable over time as you rack up an outstanding safety record year after year.

These two ideas alone could provide you with a measure of safety equal to a left tackle holding back Lawrence Taylor. It's a blind side you simply must patch up.

Robert Phelan is CEO of Construction Risk Advisors in Torrington, Conn.

Link to the article on Building & Construction Northeast's site

If you liked this article, please retweet or post to facebook.